While President Trump is challenging the election results, it appears Biden is President-Elect. As a result, tax rates are almost certain to rise now and business owners are nervous. And as with any major tax change, there’s confusion.

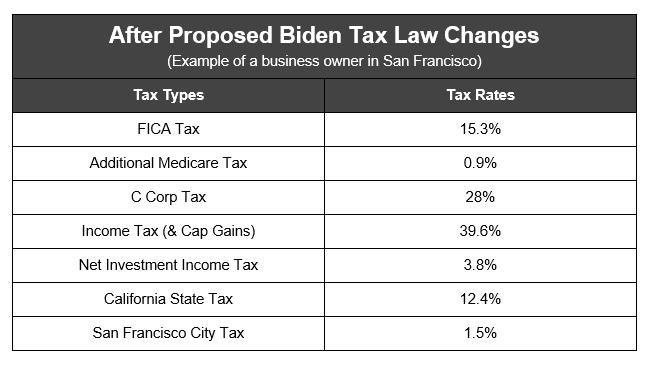

So, why are business owners asking about “101.5

It is true that if you were to add up each of these taxes, it comes to a total of 101.5

How do you give clients advice when you don’t know:

- Whether another COVID-19 bill will be passed?

- What will their business be doing in profit in 2020, 2021, 2022 or beyond?

- What the final changes to the law and tax rates will be?

- What effect will state changes have on their tax rates?

- What changes state and local governments will make with their tax laws?

- How will guidance and interpretation be enforced?

So how do you deal with all of these uncertainties and so much more? Very carefully.

Per this 2019 NATP study, the average tax and accounting firm is charging $460 per business tax return (1041, 1065, 990, 990-EZ, 1120, 1120s).

How can you possibly help clients review their business(es), personal life and tax situation to be able to deal with a potential two to three times increase in taxes for the same fee you’ve charged in the past? You can’t. If tax and accounting firms are going to help their clients get through this new era, they’re going to have to start charging for proactive planning. Otherwise their clients individually will overpay by thousands (or tens of thousands) of dollars. But the opportunity for firms is massive. How much is it worth to save a client $10,000? How about $30,000? What would they be willing to pay? Probably more than $460.

But adding proactive tax planning and advising to their practice requires accountants to make a huge shift in the way they work with their clients, one that takes them from being reactive, past-looking tax preparers into proactive, forward-looking tax planners and advisors. Those who choose to not make the shift will have dozens to hundreds of clients that are going to be paying more in taxes in the next year and for many years to come.

For tax preparers, making the shift to proactive and strategic tax planning is challenging during normal times, and these next 30 months will be anything but normal. You may be seeing the greatest increase in taxes in decades. And with fear of that looming for so many business owners, accountants will have to learn to perform tax planning with:

- Tax planning strategies for pre- or post-tax law change

- Business planning for each legal entity

- Multi-entity planning

- Multi-year planning with uncertainties in tax rates

- State tax planning

- And more

In order to be able to help, accountants need to redefine their engagements, fees and relationships with their clients. Rather than only meeting with them at year-end during tax season, they will need to meet before then and maybe in some cases every single quarter. They will need to perform proactive tax planning to not just determine what amount of taxes will be due for estimated payments, but how to re-orient the business and individual finances to reduce tax liability. This will involve not just tax planning, but also the implementation of those planning strategies and a reassessment of those implemented strategies on an ongoing basis. It may also increase the complexity of the future years’ tax preparation. While the client may be saving money, the tax structure and return may become more complicated leading to an increase in preparation fees.

In truth, you could have a tax preparation client accustomed to paying you once per year, who now ends up paying four to five times or more because of these changes. The client may pay for tax planning, implementation of those strategies, quarterly estimated payment calculations and preparation. Then once these laws change, the process may repeat itself. If there’s one thing that’s certain, tax preparers will need to level up and get involved in the changes that are coming or their clients are going to get left paying higher taxes than they have paid in their entire adult lives. And the most involved firms – those that get proactive and make the shift to tax planning – will build a new relationship with their clients and save them thousands in taxes while helping them comply with every new change in the law.

=========

Andrew Argue, CPA, is the CEO and founder of Corvee, a software and solutions company serving tax and accounting firms. At Corvee, Argue works to help tax and accounting firms increase their revenue and profitability through tax planning.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs